You are here:

Início » Public Debt » Angola, the biggest African debtor to China

February 16, 2026 17:00

Latest update:January 5, 2023

Angola, the biggest African debtor to China

African countries owe USD 696 billion (about EUR 651 billion) – a fivefold increase compared to the beginning of the millennium, with 12% of that amount due to Chinese creditors. These are data from the United Kingdom’s Royal Institute of International Affairs (Chatham House).

The study analyzes seven countries in detail, including Angola, and points out that the debt-to-Gross Domestic Product (GDP) ratio has improved in recent semesters. Essentially, due to the appreciation of the kwanza and the growth of the economy, improving from 130% in 2020 to 86.4% in 2021, and falling again to 56.6% in 2022.

But the cost of servicing the debt is expected to be close to US$13 billion (€12.1 billion) in 2022, of which 38% refer to external debt.

“Angola owes more”

Angola, in fact, owes China more than the next three countries, exceeding the sum of US$13.7 billion from Ethiopia, US$9.8 billion from Zambia and US$9.2 billion from Kenya, according to Chatham Casa, Lar.

“Debt payment, relief and cancellation continues to be a priority for President João Lourenço’s government in the second term, which began in September 2022, as well as diversifying external partnerships beyond China’s overdependence”, reads the Chatham House study.

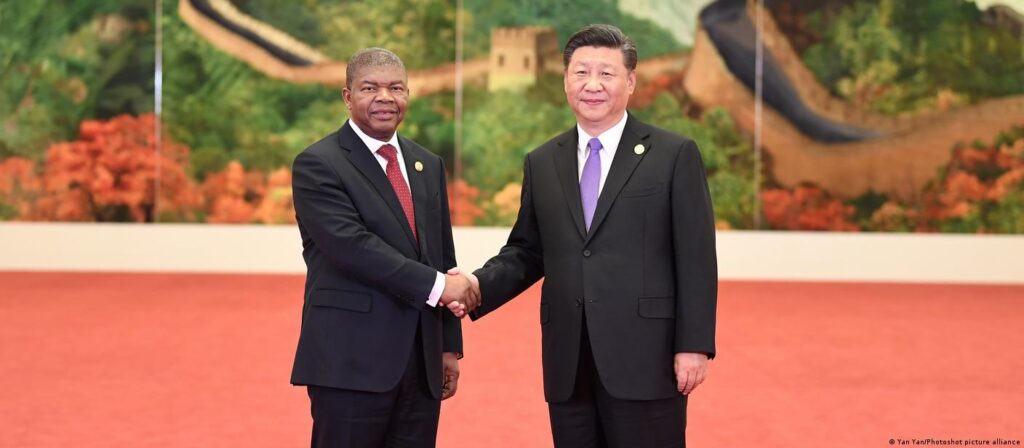

João Lourenço and Xi Jinping (file photo). Source: dw.com. Photo: Kyodo/dpa/picture alliance

The institute points out, in this sense, that the debt of African countries should be seen as “a global priority”.

China has been the biggest creditor of African countries in recent decades. It surpassed the United States, the European Union and Japan.

Entrega de vacinas a partir da China a África em 2021 (foto de arquivo). Foto: Jekesai Njikizana/AFP/Getty Images

“Trap”

But researchers at Chatham House point out that “far from being a sophisticated strategy to grab African assets, China’s loans, at an early stage, may have created a debt trap for China, which became deeply entangled with African partners. increasingly mature and assertive”.

The Asian giant is Zambia’s biggest creditor. For example, the first country to enter into Financial Default following the Covid-19 pandemic. In addition, the economic consequences not only of the pandemic, but also of the invasion of Ukraine by Russia, made other countries stop paying their debts, as is the most recent case of Ghana.

According to the criteria of the World Bank and the International Monetary Fund (IMF), 22 of the 54 African countries are over-indebted, including all Portuguese-speaking countries.

Change in interaction with Africans?

The Chatham House analysis also shows that China is changing its interaction with African countries, having put a strong brake on disbursements, which went from US$28.4 billion in 2016 to US$8.2 billion in 2019 and just 1.9 billion dollars in 2020, during the pandemic.

The debt crisis affecting African countries has motivated an intense debate among academics, multilateral banks, analysts and investors. Several observers argue that the current level of the debt-to-GDP ratio, between 60 and 70%, is unsustainable.

Chinese President Xi Jinping presiding over the Extraordinary China-Africa Summit on Chinese Aid against Covid-19 (file photo). Source: dw.com. Photo: Huang Jingwen/Photoshot/picture alliance

Analysts take into account the rise in interest rates by Western central banks and the rise in inflation, particularly in food and energy goods, which adds to the high price that investors charge to lend money to African countries, perceived as riskier in terms of payment credibility.

Source: DW

Access Counter:

PUBLIC TRANSPARENCY PORTAL – ANGOLA

Providing access to information

Municipality of Talatona, Urban District of Benfica, Estrada Lar do Patriota, Rua V, Travessa II, n.º 584-A

Postal Address: Brito Godins Postal Station, Bairro Kinaxixi, Correios de Angola, PO Box n.º 10196, Luanda – Angola

Contact phone: +244 934 035 233

COPYRIGHT © 2022 – THE PUBLIC TRANSPARENCY PORTAL IS PROPERTY OF PRO BONO ANGOLA® – ALL RIGHTS RESERVED. DEVELOPED BY 15INTELLIGENCE